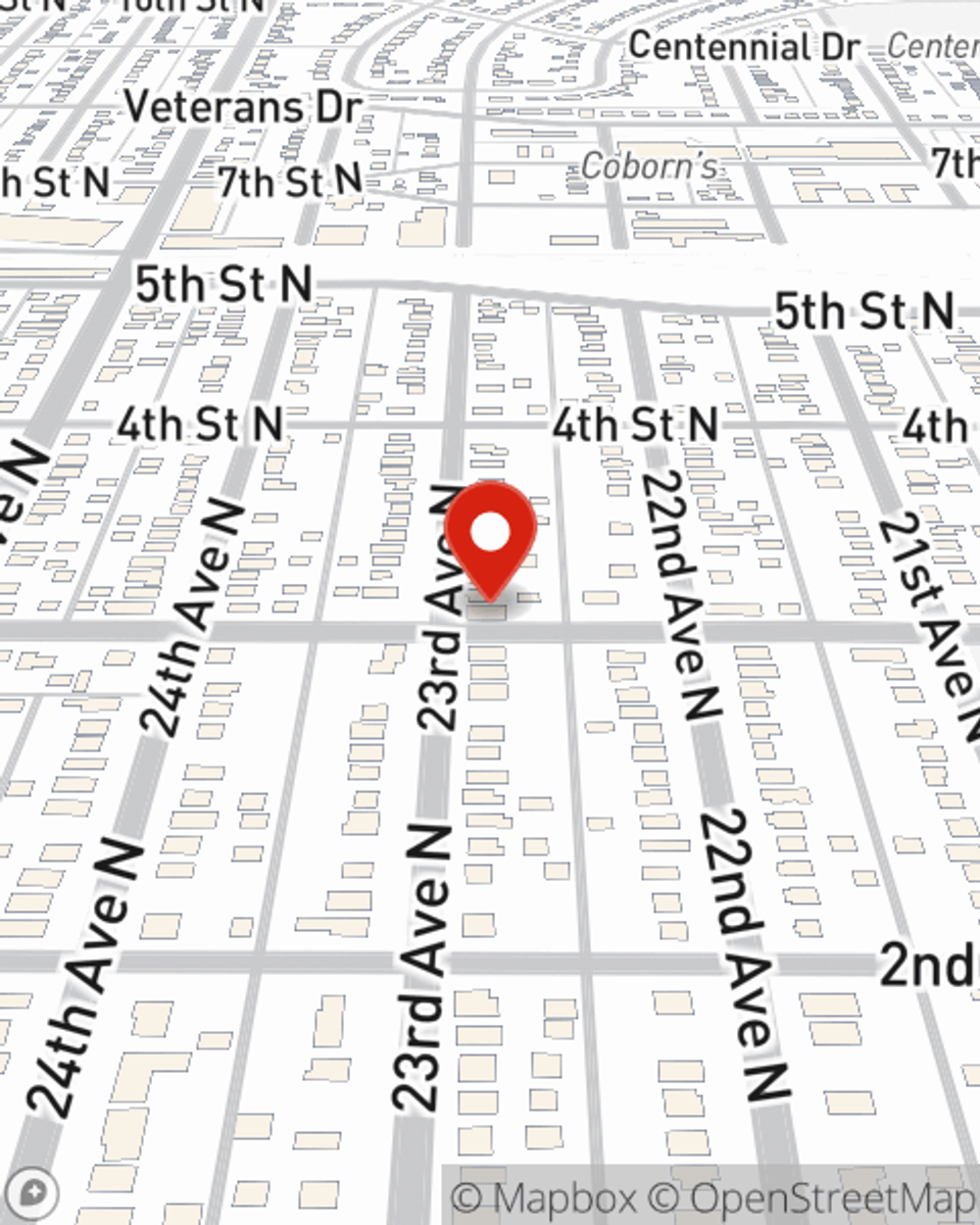

Business Insurance in and around Saint Cloud

Looking for small business insurance coverage?

Cover all the bases for your small business

- Sartell

- Waite Park

- Sauk Rapids

- Saint Augusta

- St Joe

- Rice

- Foley

- Becker

- Luxemburg

- Royalton

- Albany

- Avon

- Saint Stephen

- Saint Cloud

Business Insurance At A Great Price!

Whether you own a a window treatment store, an art gallery, or a cosmetic store, State Farm has small business protection that can help. That way, amid all the various moving pieces and options, you can focus on making this adventure a success.

Looking for small business insurance coverage?

Cover all the bases for your small business

Keep Your Business Secure

When one is as driven about their small business as you are, it is understandable to want to make sure all systems are a go. That's why State Farm has coverage options for artisan and service contractors, surety and fidelity bonds, commercial liability umbrella policies, and more.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Dan Anderson is here to help you explore your options. Call or email today!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Dan Anderson

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".